|

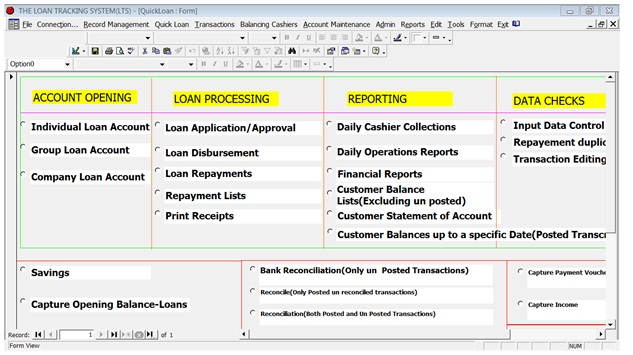

THE LOAN TRACKING SYSTEM(LTS)

The Loan Tracking System(LTS) is a system intended for use by Micro finance Institutions to facilitate loan tracking and general banking.

Loan categories supported

- Individual loans

- Group loans

- Company loans

Loan products

LTS supports an un limited number of loan products, and allocates them to customers at loan application level. Examples of loan products include: commercial loans, salary loans, school fees loans etc.

Loan application / approval

LTS has a well laid down procedure for loan processing, right from application to disbursement

Flexible interest rates

LTS supports interest computations based on monthly or annual basis

The Micro finance Institution chooses the choice that best suits their operations.

Loan repayment frequencies

Repayment frequencies supported by LTS include: yearly, semi-yearly, quarterly, monthly, bi-weekly, weekly and daily

Interest calculation methods

LTS supports the following methods of interest calculation:

- Flat rate

- Reducing balance-discounted

- Reducing balance-amortized

Loan Repayment Schedule

LTS generates a repayment schedule clearly showing a repayment time table for the loan. Customers would know when their stipulated installments are due for repayment so as to avoid un necessary penalties on loan defaults.

Recording Loan repayment

Only authorized cashiers are allowed to capture loan repayments

Automatic interest updates

For cases of monthly interest rates, the system computes interest on loan based on outstanding balance, at the end of every customer’s month, depending on when the loan was disbursed.

The interest loading wizard will identify accounts that have matured and automatically update them with the derived interest

Data capture/posting

Information recorded into the system settles in a temporary file , for error correction, pending posting at the end of the business day.

Error correction

The system has an internal mechanism to check for errors in data entry. At any time the error checking wizard can be invoked and will report any errors found , the transactions and users responsible.

Balancing off cashiers

The System enforces financial accountability for each cashier, who keeps receiving and giving out money. At the end of the business day the system will show any money held by each cashier and would balance this off against physical cash a cashier hands over to treasury.

Posting

At the end of the business day, after every cashier has balanced, data is posted to permanent storage structures. This is done through the Posting option.

Other Products supported

Other products covered by LTS include:

- Savings Accounts

- Fixed Deposits

- Shares

System Administration

LTS offers special system administration capabilities, these include:

Creation of user accounts, setting up parameters for interest computation on savings accounts, and stating minimum balances.

Others include:

Creation and modification of the chart of accounts.

Reports

LTS is rich in reporting.

Standard financial reports generated include:

- The trial balance

- Balance Sheet

- Income and expenditure

- The budget movement report

Others include:

- The loan aging report

- Loan balances report

- Loan disbursement report

- Loan application report

- Shares distribution report

Reports are generated in two forms:

The Report form and the data sheet form.

The report form is a preformatted format and can’t be changed, yet the data sheet form is an Ms-Excel format enabling users to manipulate data in any way they want eg sorting, filtering, summing up values etc.

Accounting

LTS is a fully fledged accounting package. It enables us to record all accounting information.

You can record all forms of income, expenses and loans received from banks. You can also pass journal entries.

Bank reconciliation

LTS enables us to perform bank reconciliation among other things

|